Professional Advice And Approaches For Unlocking The Secrets To Successful Retirement Preparation

Team Author-Palm Hoff

As you browse the complex surface of retirement planning, the secret to securing a fulfilling post-career life lies in precise prep work and tactical decision-making. From picturing your retirement desires to carrying out wise investment strategies, every action you take today considerably influences your tomorrow. By deciphering the keys of successful retired life planning, you can unlock a world of possibilities that assure monetary security and assurance in your golden years. So, are you ready to embark on this transformative journey towards a safe and prosperous retired life?

Comprehending Retirement Goals

To begin your effective retired life preparation trip, it's necessary to first recognize your retired life objectives clearly. Spend some time to assess what you visualize for your retired life years. Do you see on your own traveling the world, investing even more time with family, going after leisure activities, or offering? By defining your retirement goals with clearness, you can produce a roadmap for a fulfilling and financially protected future.

Take into consideration aspects such as the age you intend to retire, the sort of lifestyle you desire, any health care requires, and possible heritage goals. Understanding your objectives will certainly aid you figure out just how much money you need to conserve and how to designate your resources effectively.

It will certainly likewise direct your investment decisions and aid you remain inspired to stick to your retirement.

Structure a Solid Financial Structure

Understanding your retired life objectives provides the structure upon which you can develop a solid financial plan for your future. To establish a robust financial structure, begin by developing a budget plan that describes your existing income, costs, and savings goals. By tracking https://www.evernote.com/shard/s646/sh/0850a557-d24b-8595-520e-c1088e1642bb/zpe7nv71V1oa4cEGCt1ao5yXnpki1-RjMBnImdK2UB04Shf1p6NNkQVbsg investing practices, you can identify areas where you can cut back and designate more funds towards your retired life savings.

Along with budgeting, it's essential to build a reserve to cover unanticipated expenses without dipping into your retired life savings. Goal to set aside 3 to 6 months' well worth of living expenses in a different, easily accessible account.

In addition, take into consideration expanding your financial investments to alleviate danger and maximize returns. Explore different possession classes such as stocks, bonds, and property to produce a well-rounded portfolio that aligns with your danger resistance and retired life timeline.

Last but not least, regularly testimonial and change your economic strategy as needed to remain on track towards achieving your retired life objectives. Developing a solid financial structure calls for discipline, calculated planning, and a long-term point of view to protect a comfy retired life.

Implementing Effective Financial Investment Strategies

Think about diversifying your investment profile to boost potential returns and take care of risk successfully. By spreading please click the following post across different asset courses such as stocks, bonds, real estate, and products, you can decrease the effect of volatility in any single market.

Diversity can assist safeguard your cost savings from market downturns while still enabling development chances.

One more vital element of effective financial investment approaches is to regularly examine and rebalance your portfolio. Market conditions change, resulting in variations in the value of your investments. By reassessing your holdings periodically and readjusting them to keep your desired possession allocation, you can remain on track towards your retirement goals.

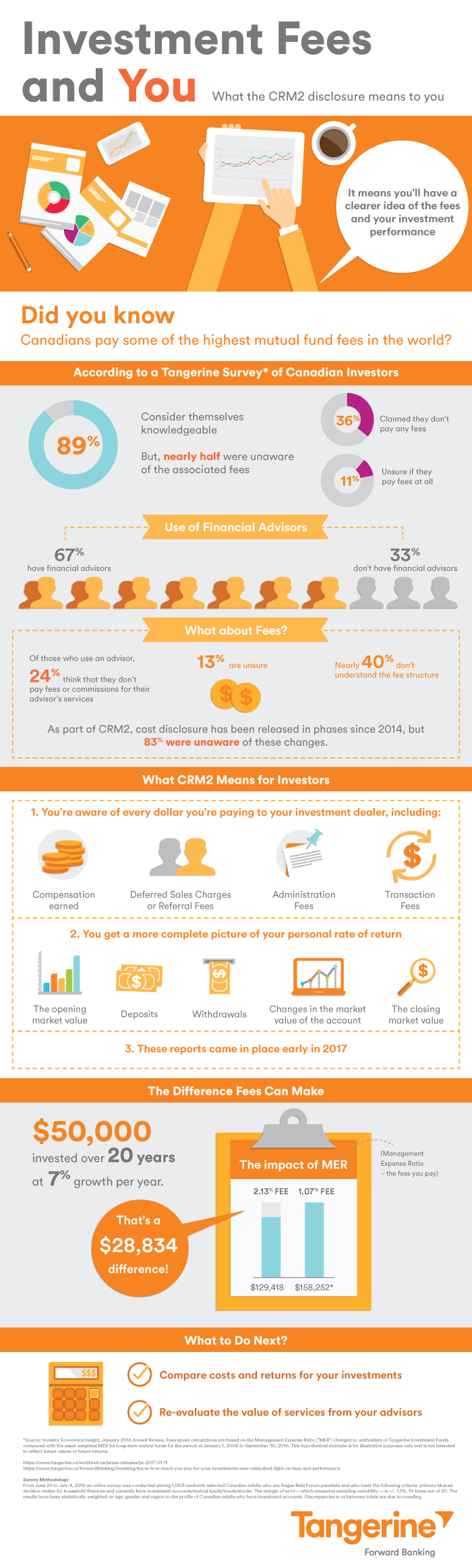

Furthermore, consider the influence of charges on your financial investment returns. High charges can eat into your earnings in time, so opt for low-cost investment options like index funds or ETFs whenever possible.

Maximizing your returns by reducing prices is a vital part of effective retired life preparation.

Verdict

Overall, effective retirement planning needs an all natural technique that addresses both monetary and individual objectives.

By imagining your retirement dreams, developing a strong financial foundation, and carrying out effective financial investment approaches, you can establish yourself up for a safe and secure and fulfilling retirement.

Remember to on a regular basis assess and readjust your plans as needed to ensure you get on track to attain your preferred results.

With commitment and self-control, you can unlock the tricks to an effective retired life.